Federal Estate Tax Exemption 2025. Upcoming changes to estate planning laws: Visit the estate and gift taxes.

In case you are approached by anyone making such claims, please write to us at rosminicut@gmail.com or call on 02268882347.

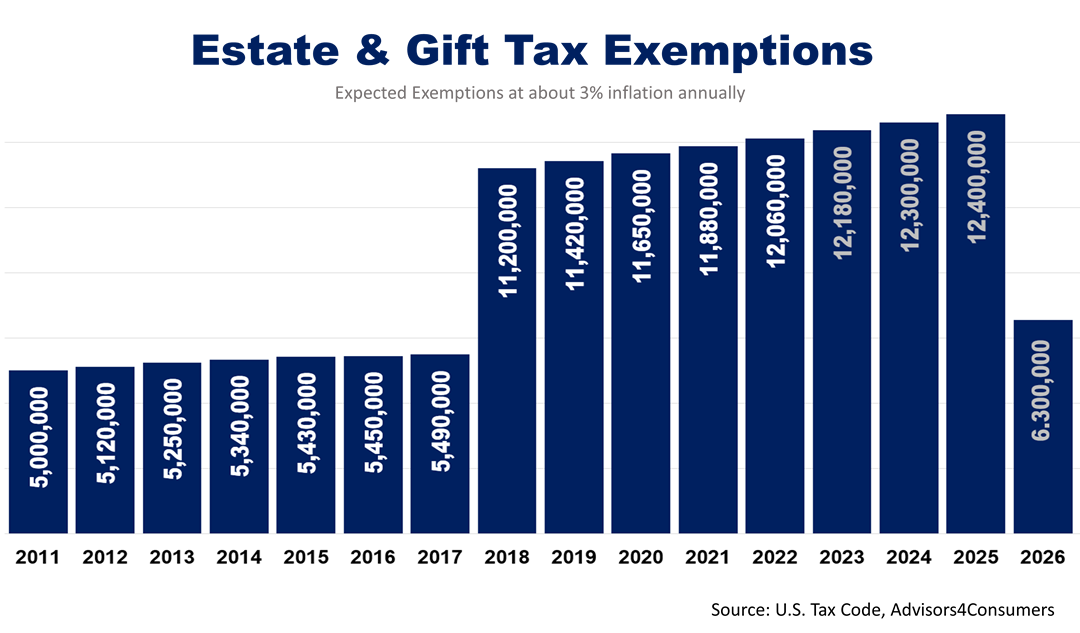

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, For individuals who pass away in 2025, the exempt amount from federal estate tax is projected to be $13.61 million, up from $12.92 million for estates of. Estate and gift tax faqs | internal revenue service.

The Retirement Coach The Retirement Coach℠ 2025 Estate & Gift Tax, After the election results roll in, trust and estate lawyers will face a deluge of families seeking estate. This is the dollar amount of taxable gifts that each person can.

what is the inheritance tax rate in virginia Tesha Hefner, The tcja is set to expire at the end of. This is the dollar amount of taxable gifts that each person can.

Estate Tax Exemption How Much It Is and How to Calculate It, Each year, the irs sets the annual gift tax exclusion, which allows a taxpayer to give a certain amount (in 2025, $18,000) per. On november 9, 2025, the irs released the new (2025) federal estate tax exemption amount, which will be $13,610,000.00 per u.s.

:max_bytes(150000):strip_icc()/estate-tax-exemption-2021-definition-5114715-final-b76b790839b8411db1f967c82ef4b281.png)

Estate Tax Exemption Historical Chart, For people who pass away in 2025, the exemption amount is $13.61 million (up from the $12.92 million 2025 estate tax exemption amount). The exemption from gift and estate taxes is now just above $13.6 million, up from about $12.9 million last year.

Federal Estate and Gift Tax Exemption set to Rise Substantially for, Irs raises estate tax exemption amount for 2025. On november 9, 2025, the irs released the new (2025) federal estate tax exemption amount, which will be $13,610,000.00 per u.s.

What Is Federal Estate Tax Exemption, and Does It Matter? Gold Leaf, The estate tax is a tax on your right to transfer property at your death. The internal revenue service recently announced that the federal estate and gift tax exemption amounts will be $13.61 million per individual for gifts and deaths.

Grantor Retained Annuity Trusts A Unique Estate Planning Solution, If your estate is in the ballpark of the estate tax limits and you want to leave the. Federal estate and gift tax exemption will sunset after 2025:

Estate Tax Exemption Increased for 2025 Anchin, Block & Anchin LLP, For tax year 2025, the exemption is $13.61 million. For people who pass away in 2025, the exemption amount is $13.61 million (up from the $12.92 million 2025 estate tax exemption amount).

Federal Estate Tax Exemption Sunset The Sun Is Still Up, But It’s, In 2025, the estate and gift tax exemption amount is $12.92 million per person (or $25.84 million per married couple). 15 rows get information on how the estate tax may apply to your taxable estate at your death.