Carry Back Nols 2025. For most taxpayers, nols arising in tax years ending after. This tax planning strategy enables businesses to carry forward net operating losses (nols) from past years to offset future taxable income.

Moreover, nols could reduce taxable income to zero in the carryback or carry forward. For net operating losses (nols) arising in tax periods beginning before january 1, 2018, taxpayers may elect to forgo the carryback period and carry the entire nol forward 20 years.

PPT ACG 3141 Chapter 16 (Part 2) Class 16 Lecture Slides PowerPoint, At the federal level, businesses cannot carry back their net operating losses.

PPT ACG 3141 Chapter 16 (Part 2) Class 16 Lecture Slides PowerPoint, For most taxpayers, nols arising in tax years ending after.

PPT ACG 3141 Chapter 16 (Part 2) Class 16 Lecture Slides PowerPoint, For most taxpayers, nols arising in tax years ending after.

Can a C corporation Carryback NOL’s? Universal CPA Review, On july 10, 2025, the treasury department issued final regulations (t.d.

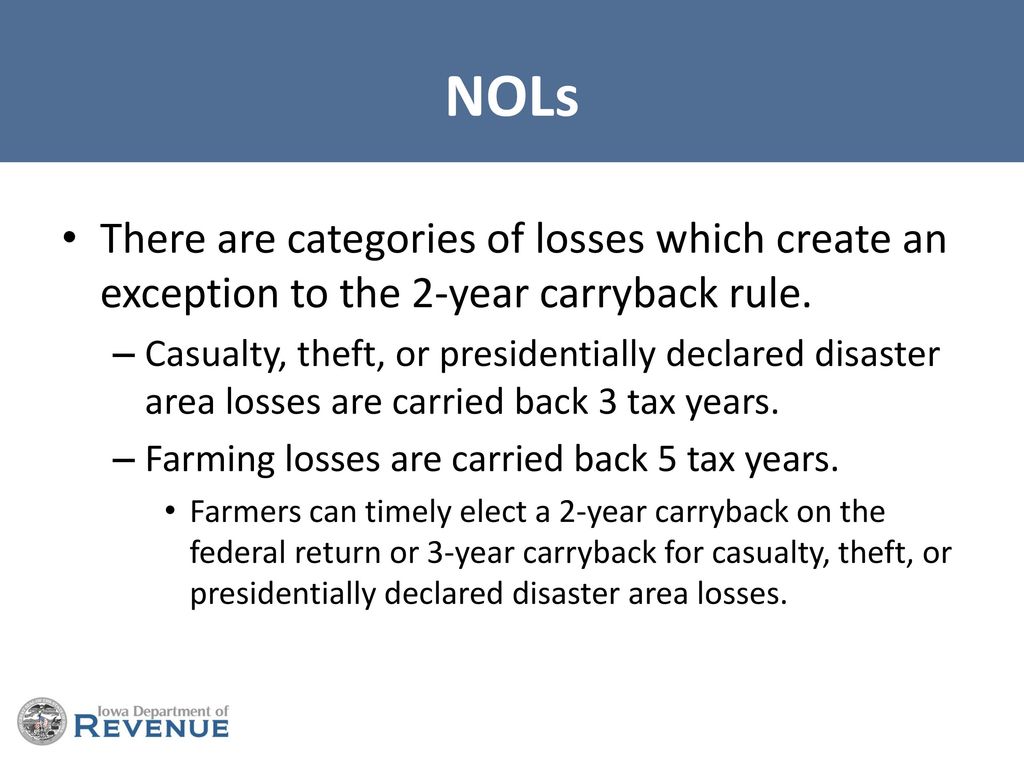

PPT ACG 3141 Chapter 16 (Part 2) Class 16 Lecture Slides PowerPoint, Prior to the tax cuts and jobs act of 2017, businesses could carry back losses for two years.

PPT ACG 3141 Chapter 16 (Part 2) Class 16 Lecture Slides PowerPoint, Before tcja, c corporations could carry nols back for two years and carry them forward for 20.

CARES Act Tax Provision Modifications to NOL Carryback & Suspends TCJA, 536 for more information on nol carrybacks.

Chapter 8 Consolidated Tax Returns ppt download, Moreover, nols could reduce taxable income to zero in the carryback or carry forward.

+(2+of+2).jpg)

Patty Fulton Jennifer Breeden ppt download, Under current tax rules, a corporation can generally carry back a net operating loss (nol) to the two preceding taxable years and carry it forward up to the 20 taxable years.